What does a freight broker do?

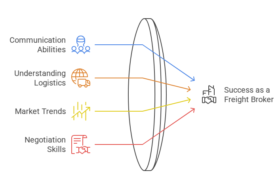

Freight brokers are filling in a crucial role in the movement of freight, as the missing link between shippers and carriers. They negotiate good shipping rates and fast deliveries from transportation companies and connect them with the businesses that need to transport goods or cargo, so carriers can maximize their loads.

Besides acting as an intermediary, brokers have an important function in the tracking of freight, as they keep thorough records of pickups and deliveries and other information. They also oversee the legal part of the transportation, as they need to be experts in shipping regulations and procedures.

Brokers are the ones who make sure that each step of the transportation process occurs so that the freight arrives safely to its final destination. To become a freight broker for trucking and transportation means to take responsibility for a vital part of the shipping process.

How to start a freight brokerage

Starting your freight brokering journey does not need to be complicated – but you do need to prepare thoroughly for launching a freight brokerage business.

So what does it take to become the much-needed middleman in the transportation industry?

Freight brokers must register with the Federal Motor Carrier Safety Administration(FMCSA). Essentially, you file an application (form OP-1) and pay a filing fee, obtain a $75,000 surety bond or establish a trust fund, and designate agents for service of legal process. The registration will remain valid as long as these requirements continue to be met.

The surety bond or trust fund is evidence of financial responsibility. This means you must demonstrate you have access to that amount of liquid assets to meet your obligations and pay any potential claims. You can either use your own resources or contract with a bonding company. Evidence of a surety bond must be filed using form BMC 84; evidence of a trust fund with a financial institution must be filed using form BMC 85.

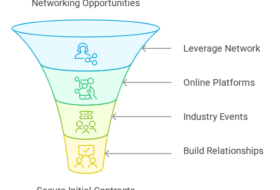

Experienced brokers recommend working in the industry—either for a shipper, a carrier or both—before starting your own brokerage. You’ll not only gain technical expertise, but you’ll also make contacts that are critical to success in this business.

Some brokers would prefer not to have to pay the carrier until they get paid themselves, but you won’t find carriers very enthusiastic about it. “Carriers take the stand that the reason they’re using a broker is so they don’t have to do credit checks on the customers or do the sales and service that we provide,” says freight broker Bill Tucker. “It’s one of the reasons the carriers will sell to you a little lower than they would bill the shipper direct.”

Solid banking relationships are critical for brokers. It’s not unusual for a new broker to need a line of credit in the range of $250,000 to $300,000 to be able to pay carriers before being paid by the shippers. If you don’t pay the truckers in a timely fashion, they won’t haul your freight. If you have nobody to haul your freight, you have no business.

Of course, you don’t want to walk empty-handed into a bank you’ve never done business with and ask for a major line of credit. Put together a professional package including a complete business plan that clearly demonstrates to the bank that you’re not a credit risk and that they’ll benefit by establishing a line of credit for you. Be sure to take your package to a commercial loan officer, not someone who handles personal accounts. Get a referral from someone who’s a good customer.

The Code of Federal Regulations is very specific about what types of records you must maintain. You’re required to keep a record of each transaction. That record must show:

- the name and address of the consignor (shipper)

- the name, address and registration number of the originating motor carrier

- the bill of lading or freight bill number

- the amount of compensation received by the broker for the brokerage service performed and the name of the payer

- a description of any non-brokerage service performed in connection with each shipment or other activity, the amount of compensation received for the service, and the name of the payer

- the amount of any freight charges collected by the broker and the date of payment to the carrier. Source:https://www.entrepreneur.com/

- Get your surety bond Today!

www.freightbrokerscourse.com15% OFF Packages above Basic.